Credit scores: understanding what impacts your rating

Advertisements

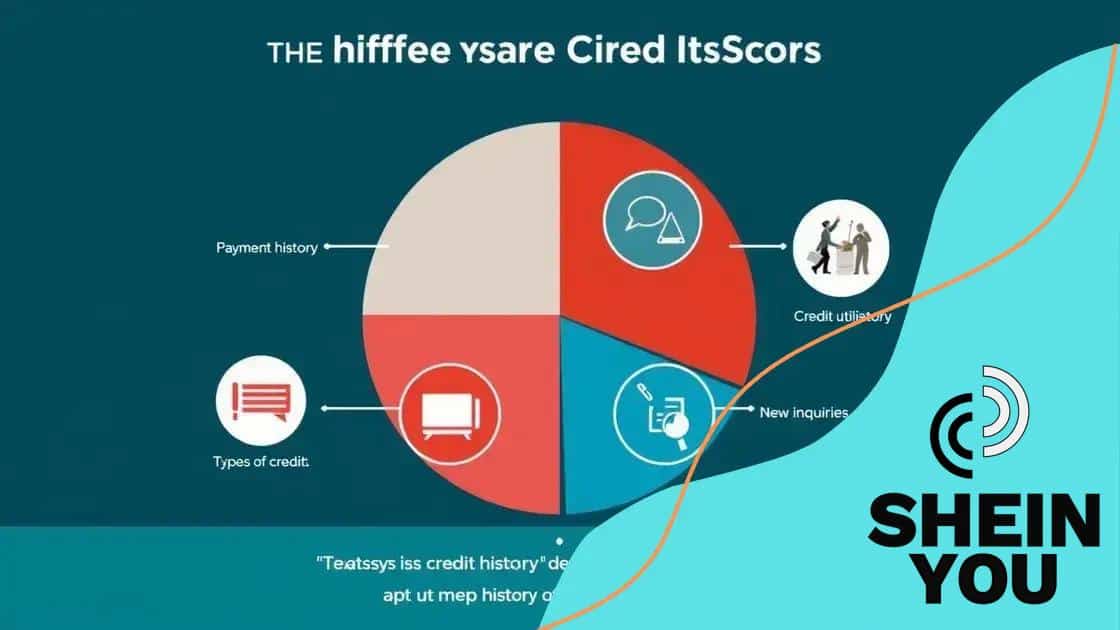

Credit scores reflect your creditworthiness, influenced by factors like payment history, credit utilization, length of credit history, and new credit inquiries, impacting your ability to borrow and secure favorable loan terms.

Credit scores: understanding what impacts your rating can feel overwhelming at first. But don’t worry, getting a grip on how these numbers work is essential for your financial future. Ever thought about what influences your score? Let’s dive in!

Advertisements

What is a credit score?

Understanding what a credit score is can greatly impact your financial journey. At its core, a credit score is a numerical representation of your creditworthiness. Lenders use these numbers to assess how likely you are to repay borrowed money.

How Credit Scores Are Calculated

Your credit score ranges from 300 to 850. Factors that contribute to this score include payment history, credit utilization, length of credit history, types of credit in use, and new credit inquiries. Let’s take a closer look at these components.

- Payment history: This is the most significant factor, making up about 35% of your score. On-time payments show reliability.

- Credit utilization: This accounts for 30% of your score. Using less than 30% of your available credit is ideal.

- Length of credit history: The longer you’ve had credit, the better, usually contributing 15% to your score.

- Types of credit: A mix of credit cards, mortgages, and installment loans helps your score.

Why Credit Scores Matter

A high credit score unlocks better interest rates and terms on loans. It’s one of the key factors lenders look at when deciding whether to extend you credit. Conversely, a low score can limit your financial options and lead to higher costs in borrowing.

Advertisements

Monitoring your credit score regularly can help you stay informed and make necessary adjustments. Consider checking your score for free from reputable sources at least once a year. This can help you catch any errors and understand your financial standing.

Factors affecting your credit score

Several key factors come into play when determining your credit score. Understanding these factors can help you manage your credit more effectively.

1. Payment History

Your payment history is one of the most critical elements, making up about 35% of your credit score. This includes whether you pay your bills on time. Consistent on-time payments demonstrate reliability to lenders.

2. Credit Utilization

Credit utilization represents 30% of your score. This ratio measures how much credit you are using compared to your total credit limit. Keeping your utilization below 30% is advisable. For instance, if your total credit limit is $10,000, try to keep your balance below $3,000.

3. Length of Credit History

The length of your credit history contributes about 15% to your score. The longer you’ve had credit accounts, the better, as it indicates experience with managing credit. Older accounts positively impact your score.

4. Types of Credit

Your credit score also benefits from having a variety of credit types, which account for 10% of your score. This may include credit cards, mortgage loans, and installment loans like car loans. A mix shows lenders you can handle different types of credit responsibly.

5. New Credit Inquiries

Finally, new credit inquiries make up 10% of your score. Each time you apply for credit, a formal inquiry occurs, which can slightly lower your score. It’s best to limit these inquiries, especially when looking to improve your score.

In summary, by actively managing these factors, you can work towards improving your credit score over time. Regularly checking your credit report will also help you stay informed about your financial standing.

Why a good credit score matters

A good credit score plays a crucial role in your financial life. It can affect your ability to borrow money, rent an apartment, and even get a job.

Access to Better Interest Rates

One of the main reasons a good credit score matters is that it grants access to better interest rates on loans and credit cards. This means that over time, you can save a substantial amount of money on interest payments. For instance, a high score could lead to an interest rate drop by a few percentage points, making a significant difference in your payment amounts.

Loan Approvals

Lenders are more likely to approve loans for individuals with strong credit scores. When applying for a mortgage, auto loan, or personal loan, a good score increases your chances of being approved. This is vital for major purchases like homes or cars.

Higher Credit Limits

A solid credit score not only helps with loan approvals but also can lead to higher credit limits. A higher limit means more available credit, which can be useful in emergencies and for boosting your credit utilization ratio.

- Less cost in insurance: Some insurance companies check your credit score as part of their assessment. A good score may lead to lower premiums.

- Better rental opportunities: Landlords often check credit scores as part of the rental application process. A high score can provide an edge over other applicants.

- Improved employment prospects: Some employers consider credit reports as part of their hiring process, especially for positions that involve financial responsibilities.

Maintaining a good credit score can empower you to take control of your financial future. Understanding its importance is key to making informed decisions that positively influence your score.

How to improve your credit rating

Improving your credit rating is a valuable goal that can enhance your financial opportunities. By following specific steps, you can boost your score effectively.

1. Pay Your Bills on Time

Making timely payments is crucial, as late payments can significantly lower your credit rating. Set up reminders or automate your payments to ensure you never miss a deadline. Paying your bills on time is a simple yet powerful way to show lenders that you are reliable.

2. Reduce Credit Card Balances

Your credit utilization ratio should ideally stay below 30%. This means if your credit limit is $10,000, you should keep your balance under $3,000. Paying down your existing balances can directly boost your credit score.

3. Keep Old Accounts Open

The length of your credit history plays a role in your score. Closing old accounts can shorten this history and negatively impact your credit rating. Even if you don’t use them often, keeping these accounts open can be beneficial.

4. Limit New Credit Applications

Each time you apply for new credit, a hard inquiry is made, which can lower your score temporarily. Instead of frequently applying for new credit, consider applying only when necessary. This will help maintain your score over time.

- Check Your Credit Report: Regularly review your credit report for errors. Dispute any inaccuracies you find, as these can harm your score.

- Consider a Secured Credit Card: If your score is low, using a secured credit card can help you build it back up. These require a cash deposit that serves as your credit limit.

- Become an Authorized User: Having a good friend or family member add you as an authorized user on their credit card can help improve your score, provided they have a positive payment history.

By actively following these steps, you can gradually improve your credit rating. Remember, it’s a journey, and making consistent efforts will pay off.

Common credit score myths

Many people have misconceptions about credit scores. Understanding the truth can help you improve or maintain a healthy score.

Myth 1: Checking Your Credit Score Lowers It

One common myth is that checking your own credit score will lower it. This is false. When you check your score, it’s considered a “soft inquiry” and does not affect your credit rating. In fact, regularly checking your score can help you keep track of your financial health.

Myth 2: Closing Old Accounts Improves Your Score

Many believe that closing old credit accounts is beneficial. However, this can actually hurt your score. Keeping older accounts open helps to increase the length of your credit history, which is a positive factor in calculating your score.

Myth 3: A Good Score Is Always Above 700

While a good credit score is often thought to be above 700, the scoring range varies. For example, scores of 640 to 699 are generally considered fair, while anything above 700 is good. Understanding the specific ranges used by lenders can clarify what is considered a good score.

Myth 4: You Only Need Good Credit for Loans

Some people think that a good credit score only matters if you are looking for loans. This is not true. Your credit score can affect various aspects of your life, including insurance rates and rental applications. Landlords often check credit scores before approving leases.

- Myth 5: Paying off debt removes it from your credit report. This is incorrect. While paying off your debt is positive, the account will still appear on your report.

- Myth 6: You cannot improve a low credit score quickly. In reality, taking steps such as reducing credit utilization can lead to improvements over time.

- Myth 7: All credit scores are the same. Different scoring models may yield different scores, so it’s essential to check the specific score that lenders use.

By debunking these credit score myths, you can make informed decisions and take appropriate actions to improve your financial standing.

FAQ – Frequently Asked Questions about Credit Scores

What is a credit score?

A credit score is a numerical representation of your creditworthiness, used by lenders to evaluate the risk of lending you money.

How often should I check my credit score?

It’s a good idea to check your credit score at least once a year to ensure accuracy and monitor any changes.

Can paying off debt improve my credit score immediately?

While paying off debt is beneficial, it may take some time for your score to reflect the changes. Regular, timely payments can lead to gradual improvements.

What are some common myths about credit scores?

Some myths include the belief that checking your own score lowers it and that closing old accounts improves your score. Understanding the truth can help you manage your credit better.